Virtual Banks in Asia See Prime Time

The pandemic has propelled contactless and cashless transactions in Asia at warp speed, paving the way for virtual banks.

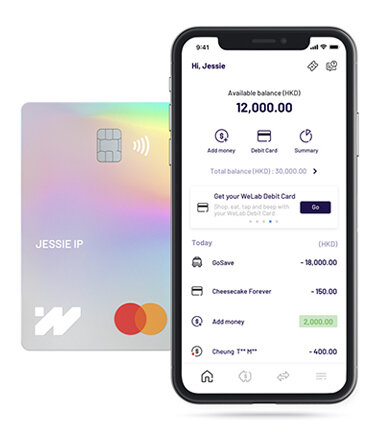

Fintech News showed that approximately 16% of Hong Kongese currently have a virtual bank account, while 12% of Hong Kongese are planning to open one in the next 5 years. WeLab Bank, one of Hong Kong's homegrown virtual banks, has already seen customers taking advantage of the 24/7 fully remote access and user-centric experiences. Hong Kong is a perfect landing pad for fintech companies eyeing opportunities in Asia. With its established and vibrant ecosystem, the city has enabled fintechs like WeLab to innovate and develop.

Southeast Asia has also seen a boom in virtual banks. Singapore, for example, has strengthened its focus on the digital economy in recent years, pushing legal tech and pitching itself as a regional leader in business innovation. Monetary Authority of Singapore (MAS) announced that 4 entities were awarded digital banking licenses. Virtual bank licences have been something of a work in progress in Singapore over the past few years, and despite the pandemic, this process has remained on track.

The internet has dramatically changed the behaviour of bank service users. They can now make financial transactions using their smartphones anytime, compare interest rates and Forex on Google, and thanks to social media they can learn the bank service before stepping in a branch. The need for traditional banks is gradually decreasing, giving an opportunity for the rise of virtual banks.

Marketing for virtual banks is not just about advertisement. Good UX/UI of the banking app is a must and engaging social media content will be a bonus. Brands need to move beyond simple touch-points to create ongoing relationships with consumers.

Source : WeLab

Please subscribe to our newsletter if you want to know more about Asian marketing. Leave your comments below to share your thought with us, and check out our thoughts on social media!