Magic Tool or Money Pit: Unlocking China’s KOL Marketing

The prominence of KOL (Key Opinion Leader) marketing has risen significantly in recent years. Over the years, many brands have prioritised this strategy within their marketing campaigns. However, as KOL marketing continues to expand, it hasn't been immune to criticism. Reports of falsified follower data, conversion rates, and sales results have fostered a degree of scepticism towards this approach. Amid this backdrop, KOC (Key Opinion Consumer) marketing has emerged, becoming an increasingly integral part of marketing strategies. This raises two critical questions: Is KOL marketing losing its magic? And how can we navigate KOL and KOC marketing in China's increasingly complex media landscape? In this article, we will explore the ascendance of KOC marketing in brand communication, delving deep into the evolution and future prospects of KOL marketing.

The rising popularity of KOCs

a) KOL vs. KOC: Fans' Motivations and Engagement

KOLs in China normally are renowned experts in their respective fields, making them highly influential sources of information for Chinese consumers. While KOLs are followed for their unique styles and attitudes, KOCs primarily attract fans through their genuine product promotions. Like common and ordinary consumers themselves, they love to share their honest product reviews on social media platforms. Consequently, their views carry significant weight within their social circles, especially within user communities, and they engage with their followers on a more interactive and personal level.

source: Linkedin

b) Consumers' Demand for Quality and Authenticity

Having a large fan base can be a double-edged sword. While it signifies high attention and ideally more traffic for brand promotion, it can also result in higher fees and, at times, lower trust from the audience. As consumers become more discerning, they are aware that KOLs are often compensated for their reviews and product endorsements. Consequently, they seek more relatable and genuine reviews and recommendations from influencers. This demand for quality and authenticity in marketing has led to a surge in KOCs. In 2022, the number of KOLs increased by 14%, with KOCs accounting for the majority at 76%. Among the various platforms, Rednote (Xiaohongshu / RED) boasts the highest percentage of KOCs at 81%, highlighting the importance consumers place on authentic experiences and recommendations.

c) Multi-circle Coverage in Brand Communication

The authenticity inherent in KOC (Key Opinion Consumer) content has led platforms to encourage its proliferation through traffic generation and creative inspiration mechanisms. Consider Douyin's 'crowd seeding' initiative as an example. Brands engage KOCs to share videos detailing their experience with products. Through curating high-quality videos for further promotion, brands enhance their product visibility among consumers, while KOCs reap benefits from amplified exposure of their brand-related content.

The rise of KOC marketing signals a shift in influencer evaluation metrics. Rather than solely focusing on follower count, the quality and frequency of content creation have come to the fore. This has driven brands to consistently elevate the standard of content, demonstrating the evolving dynamics of effective influencer marketing

The distinction between KOLs and KOCs signifies a shift in consumers' motivations and preferences. While KOLs remain impactful in improving the brand's image, KOCs have gained prominence by offering genuine product promotions and honest reviews, meeting the demand for quality and authenticity. Both KOLs and KOCs play essential roles in connecting brands with consumers, but the rise of KOCs reflects the increasing emphasis consumers place on relatability and authenticity in their purchasing decisions.

KOL Marketing: A different Landscape

Before examining the evolution of KOL marketing, it's important to understand the differences between Chinese social media platforms and their Western counterparts. Popular Western platforms, including Instagram, Facebook, and Twitter, are either inaccessible or not widely used in China. In contrast, the top six platforms shaping China's digital landscape are WeChat, Weibo, Douyin, Kuaishou, Zhihu, and Rednote (Xiaohongshu / RED).

Each of these platforms has its unique characteristics and user base, providing diverse opportunities for KOL marketing strategies.

Furthermore, the categorisation of KOLs varies between Western and Chinese platforms. On Western platforms, influencers are divided into categories based on follower count, with mega-influencers having 1 million or more followers, micro-influencers having between 10,000 and 100,000 followers, and nano-influencers having fewer than 10,000 followers. In contrast, KOLs are classified on a more sophisticated level on Chinese platforms:

Mega KOLs: Over 10 million followers

Macro KOLs: 1 million to 10 million followers

Mid-tier KOLs: 500,000 to 1 million followers

Micro KOLs: 100,000 to 500,000 followers

Nano KOLs: 20,000 to 50,000 followers

Chart from Statista, source: iiMedia Research

Moreover, the development of Multi-channel Networks (MCNs) has added a distinctive dimension to KOL marketing in China. MCNs are third-party services collaborating with multiple channels and creators to develop content. These networks provide professional training and resources to influencers, contributing to the systematic growth of the KOL industry. As of 2021, China had approximately 30,000 MCNs, playing a significant role in shaping the country's most prominent internet celebrities.

Importance of China KOL Marketing

a) Substantial Market Share and trending marketing strategy

According to the National Bureau of Statistics, China's influencer economy grew from CNY 241.9 billion ($38.5 billion) in 2018 to CNY 1.3 trillion ($210 billion) in 2020.

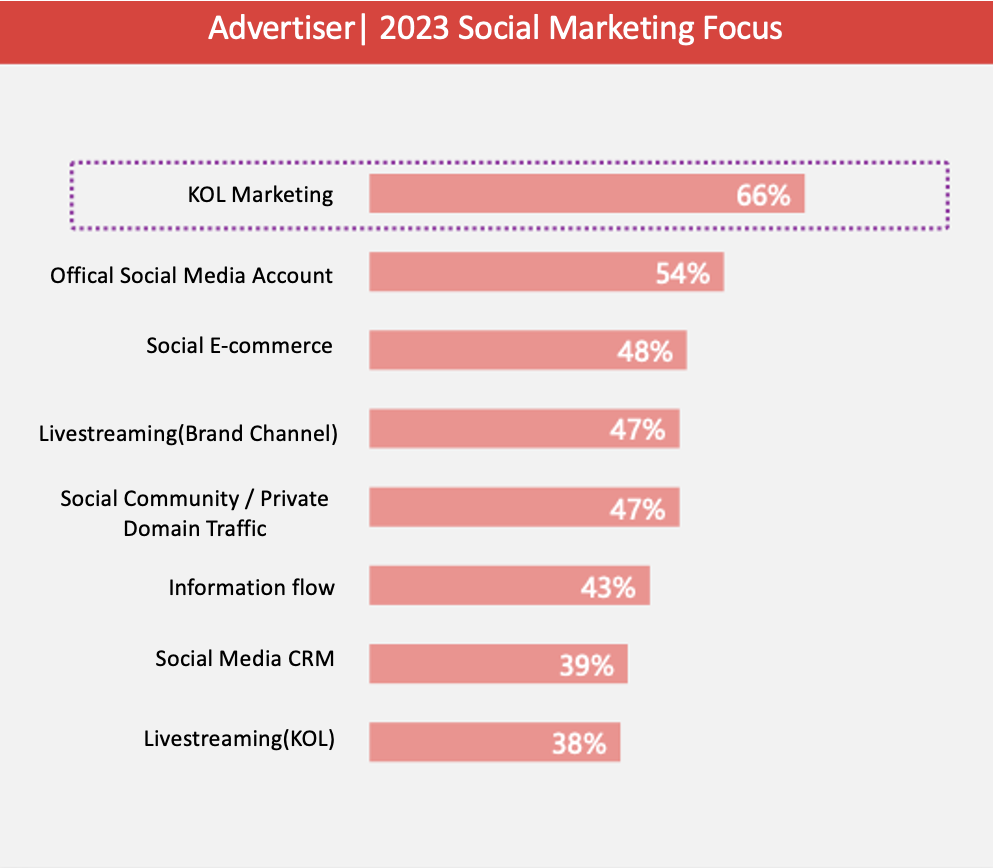

Projections indicate that by 2025, the market size of China's influencer economy will reach CNY 6.7 trillion ($1.035 trillion), signifying immense growth and opportunities in the China KOL marketing space. The 2023 KOL Marketing Trend White Paper reveals that around two-thirds of surveyed advertisers have prioritised KOL promotion as the central focus of their social marketing strategy for 2023. Official social media account operations and social commerce also rank high as influential channels.

b) Socially Engaged with Gen-Z: Authenticity and Trustworthiness

China KOL marketing has proven highly effective in promoting fashion, cosmetics, and food products in China. Chinese consumers, faced with a saturated and untrustworthy market, seek direction from individuals they trust when making purchasing decisions.

In today's Chinese market, characterised by an abundance of noise and decreased trust, consumers actively seek guidance from individuals they trust before making purchasing decisions. With the rapid growth of social media platforms like WeChat and Weibo, China's influencer landscape has expanded, becoming increasingly diverse. The undeniable popularity of these influencers underscores their role in shaping consumer preferences and behaviours.

Source: 2023 KOL Marketing White paper (translated by Comms8)

c) Powerful Brand Growth through KOL Marketing

KOL marketing is acknowledged for its power in promoting brands, especially new ones, on social media platforms, creating a reliable and sustained buzz. A shining example of a domestic brand that has embraced KOL collaborations as a cornerstone of its marketing efforts is Perfect Diary. Founded in 2017, Perfect Diary wholeheartedly embraced KOL collaborations, with a particular focus on the platform Redbook. Perfect Diary adopted a pyramidal strategy for the KOL collaborations, utilising influencers from different tiers to maximise their impacts. They worked with mega and macro influencers for product endorsements, mid-tier and micro-influencers for large-scale product seeding and nano-influencers for customer testimonials. This comprehensive approach allowed Perfect Diary to cover a wide range of audiences.

The success continued for Perfect Diary in subsequent years. In 2020, the brand ranked as the number one beauty brand on Tmall's Double Eleven, generating a remarkable $600 million in sales. By 2021, Perfect Diary's official account on Redbook boasted an impressive following of approximately 1.92 million followers. These investments in KOLs played a pivotal role in the rapid rise of Perfect Diary, achieving annual sales of CNY 3 billion in just three years and increasing their valuation by an astounding 130 times.

Source: Rednote (Xiaohongshu / RED)

The allocation of social marketing budgets underscores the significance of KOL marketing by emerging advertisers and brand owners. According to the 2023 KOL Marketing White Paper, a substantial 81% of social marketing budgets are dedicated to KOL marketing. For advertisers, the primary objectives for KOL marketing in 2023 include product seeding, brand communication, and driving conversions, reflecting the recognition of KOLs as effective influencers in reaching and engaging the target audience.

Source: 2023 KOL Marketing White paper (translated by Comms8)

Unique Dimensions of Different Platforms

KOLs on different platforms cater to specific audience preferences and interests. In the face of the ever-changing media environment, it is important to understand the popular categories on prominent Chinese platforms:

Weibo: Entertainment, Fashion, Cosmetics, Food

Douyin: Entertainment, Food, Games, Beauty, Music, Drama

Kuaishou: Games, Entertainment, Drama, Food, Beauty

Zhihu: Humanities, Romance, Education, Film & TV, Cosmetics, Digital, Science

Bilibili: Games, Animation, Food, Entertainment, Knowledge Sharing, Music, Education

Rednote (Xiaohongshu / RED): Fashion, Cosmetics, and Food, with an increasing focus on entertainment and daily life sharing.

Douyin Livestreaming of @Crazy Young Brothers

Moreover, a new trend of “Vertical KOLs” is emerging, with a growing segment of consumers seeking more professional, in-depth, and useful content. "Vertical KOLs" specialising in providing detailed information about product features and functionality are gaining popularity among Chinese consumers.

The rise of "Vertical KOLs" is supported by the growing consumer desire for detailed product information. Chinese consumers are actively seeking comprehensive insights to make informed purchasing decisions, as highlighted in a report by McKinsey. As a result, these specialised KOLs have gained popularity by offering valuable guidance and assisting consumers in their decision-making process.

The categories of KOLs and their increasing specialization, combined with the growing consumer demand for detailed information, highlight the importance and effectiveness of KOL marketing in China's dynamic social media landscape. As Chinese consumers continue to seek authentic and informative content, KOLs will play a crucial role in connecting brands with their target audience and driving meaningful engagements and conversions.

In conclusion, notwithstanding the scepticism, KOL marketing in China continues to serve as a potent instrument for brand promotion and communication. It offers brands unmatched prospects for reaching and engaging their intended audience. To tap into the full potential of KOL marketing, it's crucial to stay abreast of the evolving dynamics involving KOLs, KOCs, content innovation, and the variety of platforms and formats at one's disposal.

At Comms8, we specialise in helping businesses leverage the power of both KOL and KOC marketing in China. With our expertise, we can assist you in harnessing the influence of KOLs to boost your brand's credibility and awareness. Contact us today to learn more about empowering your brand in the dynamic Chinese market.

Reference: Statista, Miaozhen China, Mckinsy, Topklout.com